Money Market Funds keep getting Bigger

- Wayne Jordan

- Aug 14, 2025

- 2 min read

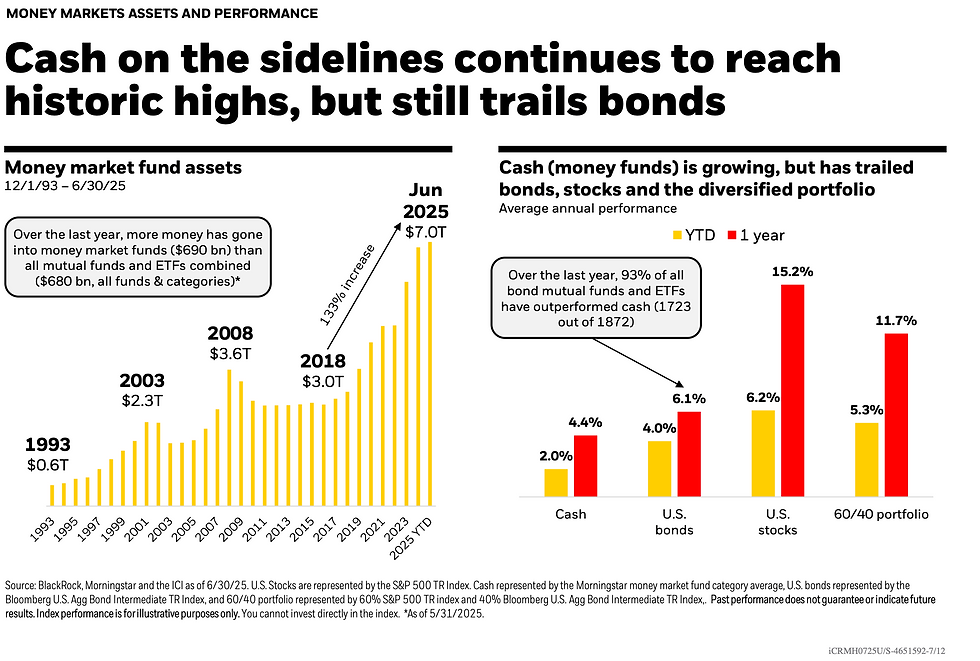

Reading Blackrock’s latest Student of the Market LINK this caught my eye:

The amount in money market funds has ballooned to $7 trillion dollars. A massive increase over the past few years, driven primarily by a rise in interest rates.

Right now the money market fund we mainly use for clients, SWVXX, is earning 4.12%. That’s a really good return for just parking your money somewhere temporarily.

And that’s how you should view money markets too: as a placeholder or parking spot.

Money market funds are not a great long-term investment. The chart on the right of the page starts to explain (unfortunately they only look at the past year but it still tells the story).

Almost every other investment has outperformed the money market fund. This is to be expected!

Money market funds don’t carry a lot of risk (they aren’t risk-free, though!), so you can’t expect them to deliver a great return. We can never forget the rule: whoever takes the risk gets the reward. Money market funds are designed to not take a lot of risk, so they aren’t going to provide a lot of reward.

In periods like today where you can earn decent interest in a money market fund investors naturally wonder where money market funds fit into their investment portfolio.

I would argue they don't... they're more of a cash management tool than an investment.

Here's why:

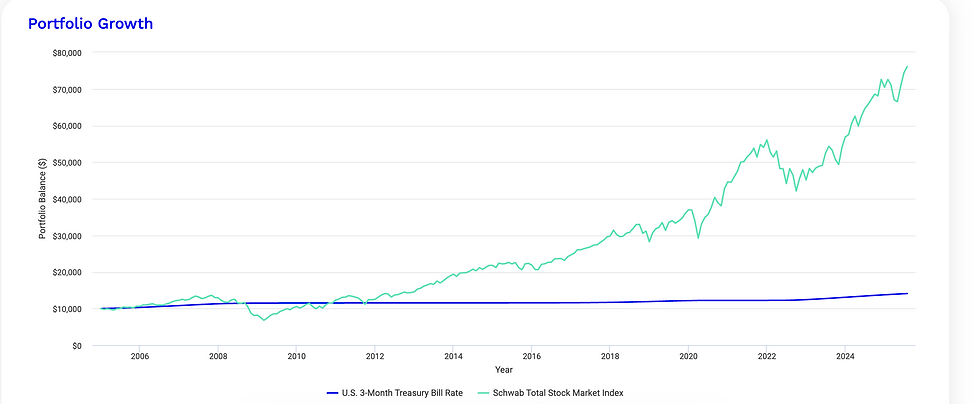

We want to invest for the long-term, so how does a money market fund perform over a decade or two?

Comparing stocks to money market funds over a long period is silly but I’ll do it anyway. Let's look at how $10,000 would have grown over past 20 years, vs money market funds:

Not surprisingly the stock market blows out money markets.

But we know money market isn't a substitute for stocks. What about for bonds?

This is a question clients often ask. Get strong interest with less risk. That’s a great thought, but even then if you look at the historical performance over the past two decades you would have been better off in bonds. Not by a lot, but still better!

My point is not anti-money markets. I actually think they’re a great tool, and we use them for a lot of clients, but I draw the line at calling them part of the investment portfolio.

They’re a good placeholder for cash and somewhere to park money when we don’t want to take stock market risk, but if we’re looking for longer-term savings without all of the risk of the stock market I’m still going to be using a diversified bond portfolio.

Comments